PLEASANTVILLE, NY. – That private capital has been unsuccessful in a leveraged buyout of Reader’s Digest Association Inc. should be no surprise. Private capital like Ripplewood Holdings has failed in all manner of media plays. The reality is that during a downturn, a company can’t be expected to be paying borrowed capital. Simple as that.

PLEASANTVILLE, NY. – That private capital has been unsuccessful in a leveraged buyout of Reader’s Digest Association Inc. should be no surprise. Private capital like Ripplewood Holdings has failed in all manner of media plays. The reality is that during a downturn, a company can’t be expected to be paying borrowed capital. Simple as that.

The Digest’s durability over the years was because it was all paid for. Its headquarters was paid for. Its debt was nil. And so during a downturn, of which there were many during its long history, it could survive.

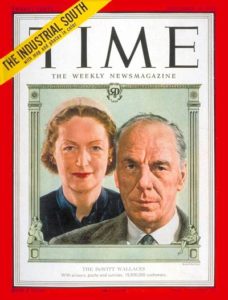

The story of the breakup of Reader’s Digest is a sad tale, detailed in Peter Canning’s excellent biography of founders Dewitt and Lila Wallace. The undoing begins with the literal suffering of Dewitt and Lila Wallace during their last days at High Winds, their estate. In senility, Lila Wallace’s staff was taken away one-by-one, and she wore ragged nightgowns. Dewitt Wallace literally died with untreated cancer, his guts spilling out at home. When she died, Lila Wallace’s ashes were spread over her Rose Garden. She felt secure about this; before she died she had seen to it that High Winds would be a part of Reader’s Digest permanently, and used as a conference and retreat center. But the estate was sold in 1985; her Rose Garden dug up for new owner, investor Nelson Peltz.

I mention all of this because it shows how far the company strayed from its founders, not only in its editorial mission, but it its whole respect for the Wallace legacy. Like Walt Disney, the BRAND was the Wallaces. To keep the idea alive, you need to have a healthy respect for the founders and their legacy. Certainly, you can change things, but whatever you do has to come out of a healthy respect for the brand and franchise. That was far from the case in Pleasantville.

A few weeks ago, and totally oblivious to bankruptcy issues, I wrote on how the early Reader’s Digest was literally the first “WEB 2.0” media product, with elements of blogs, HuffingtonPost, Drudge Report and other elements. Having started a state magazine at the height of the last recession, I thought that the magazine during this recession is perfectly positioned for today, if it could only understand what made it great.

I don’t think it understands its strengths.

A few thoughts on what surviving investors like J.P. Morgan Chase (JPM), Bank of America’s Merrill Lynch (BOA), GE’ GE Capital (GE) Eaton Vance Investment Managers, Regiment Capital Advisors LP and Davidson Kempner Capital Management LLC, need to do, here on out.

- Focus on its data: Reader’s Digest has a powerful subscription database; over eight million. It needs to use that data to sell other one-off products.

- Be aggressive: Keep launching new magazines and web portals. Just because they are doing it now doesn’t mean it isn’t the right formula.

- Stop the focus on costs. Publishing has overhead; you have to grow revenue. If you cut the overhead, you cut the brains that make the product. You can’t make cars without a factory, and you can’t publish magazines and websites without editorial and sales staff.

- Buy regional titles: A magazine no longer stands on its own. A magazine is a front-piece to a web portal and a web brand. The Digest has the scale to build each of them into a franchise. I made a quick list off the top of my head.

- Keep going with the magazine: In recent editions, Peggy Northrop has begun to take the magazine back to its hopeful state. They need to make sure they stay true to the original vision.

- Launch a true web edition: The web is packed with great things; a DIGEST of the web would be a powerful publishing company.

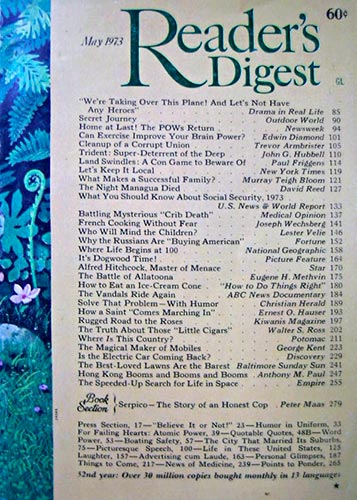

- Think about putting the index on the cover again. There is a reason why it worked; it was part of the brand. Remember the Digest had an index on the cover all during the era of Life and Look. In an overloaded era of graphics, reading and type becomes restful.

- Honor the Wallaces. There is some bad juju when you sell of the family silver and you sell off the Rose Garden where your founder is buried, against her wishes. Reader’s Digest needs to do some things to mend those mistakes, or they will keep making them again and again.