Drive Thru Restaurant Analysis?

Drive Thru Restaurant Analysis?

SARASOTA – Here in this retiree mecca, you can get a pretty good indication of the health of America’s restaurants as you drive down our highway strip, Tamiami Trail. Of the chains along U.S. 41, a newly opened Chipotle Mexican Grill (CMG) is packed, and all the fast food restaurants are equally busy. Steak & Ale, Waffle House and Village Inn (the latter part of VICORP Restaurants Inc. and in Chapter 11) are all closed, though a franchised Bennigan’s still survives, even as its Plano, Texas parent company Metromedia Steakhouses is bankrupt. Starbucks (SBUX) is less busy than before, but healthy. Denny’s (DENN) is busy at breakfast, and seems to be trying hard, but it just feels tired. Sadly, The “Waffle House Do Wop” no longer plays at our closed Waffle House.

But the olives are still ripe at Olive Garden, one of the handful of restaurant concepts of Orlando-based Darden Restaurants Inc. (NYSE: DRI). It’s risky researching the fundamentals of a consumer goods stock just on the experience you get as a customer, but you learn things first-hand that you could never find in an annual report. So I went in for lunch.

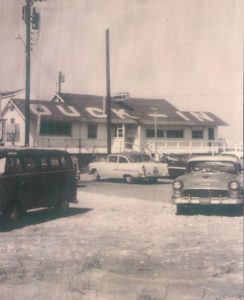

Darden’s founder was Bill Darden, an old school restaurateur. He was a Southern man of the same generation as my grandfather, who ran a seafood restaurant in Virginia Beach, Virginia. Through his actions, my grandfather taught me how to look at the elements of a well-run restaurant; his seemingly simple priorities were consistent food, clean surroundings, a friendly staff and a focus on pennies. Darden Restaurants started with a single Red Lobster in Georgia. Today, the company has 1,700 restaurants and concepts that include LongHorn Steakhouse, The Capital Grille, Bahama Breeze and Seasons 52.

So as not to turn this piece into a restaurant review, I won’t tell you what I ate at Olive Garden Number 1114. But I will tell you that the restaurant did the following things, things that far more expensive restaurants miss. It is hard to execute at 1,700 restaurants, but Darden does. The lunch made the stock worth a second look, namely:

The door was opened for us by a restaurant greeter. We were seated by hostess within 30 seconds. Wine was offered. Bread and salad came out quickly, accompanied by a hot bread plate and a cold salad plate, two things I thought had completely disappeared. Food was delivered within 10 minutes. Water was brought without asking, another throwback. Our waiter named “Scott B” was pleasant, but did not have an annoying “Hello, I’m Scott” script from corporate.

The restaurant was busy. All the tables were turning quickly, another good sign. Of the customers, it was a mix of business lunches, elderly couples and other middle-aged children taking elderly parents to lunch. This is proof that there is a market for good restaurants even in a downturn; both Olive Garden and Red Lobster cater to the retired. Our waiter, Scott B, said goodbye with a terribly smart greeting. “Thanks for coming in. We’ll see you in four or five days.” As we left, we were greeted again by the hostess. By the front door was a plaque with manager’s name, C.J. Johnson, carved in stone, just so you know who is accountable.

This was the same experience a month ago at a Red Lobster in Melbourne, Florida, where a quite sophisticated retiree that I took to lunch suggested Red Lobster. He felt the need to tell me why. He was simply hungry for the dish he had seen in an ad. And there was a second reason. The portions were large enough that he could take half of it home and make a second meal out if it. In a downturn, consumers are shopping price and value.

Darden’s stock price has understandably held up quite well compared to the rest of the sector, whose ills need no explanation. Struggling are Ruby Tuesday (RT) and Ruth’s Hospitality Group Inc (RUTH) which has a NASDAQ stock price just over $2. Ruth’s is so cheap that you wonder if they just offered each customer 50 shares over dinner with the dessert that they might actually be able to raise the stock to a reasonable place.